The global electric drive market size is estimated to be USD 2.551 billion in 2024, and is projected to reach approximately USD 18.77473 billion by 2025.

In the first three quarters of 2024, the cumulative installed volume of new energy vehicle drive motors in China reached 9.884 million units, representing a year-over-year growth of 38.2%. The market size of China’s new energy vehicle drive motors reached RMB 23.267 billion in 2023, and is expected to reach RMB 55.763 billion by 2030.

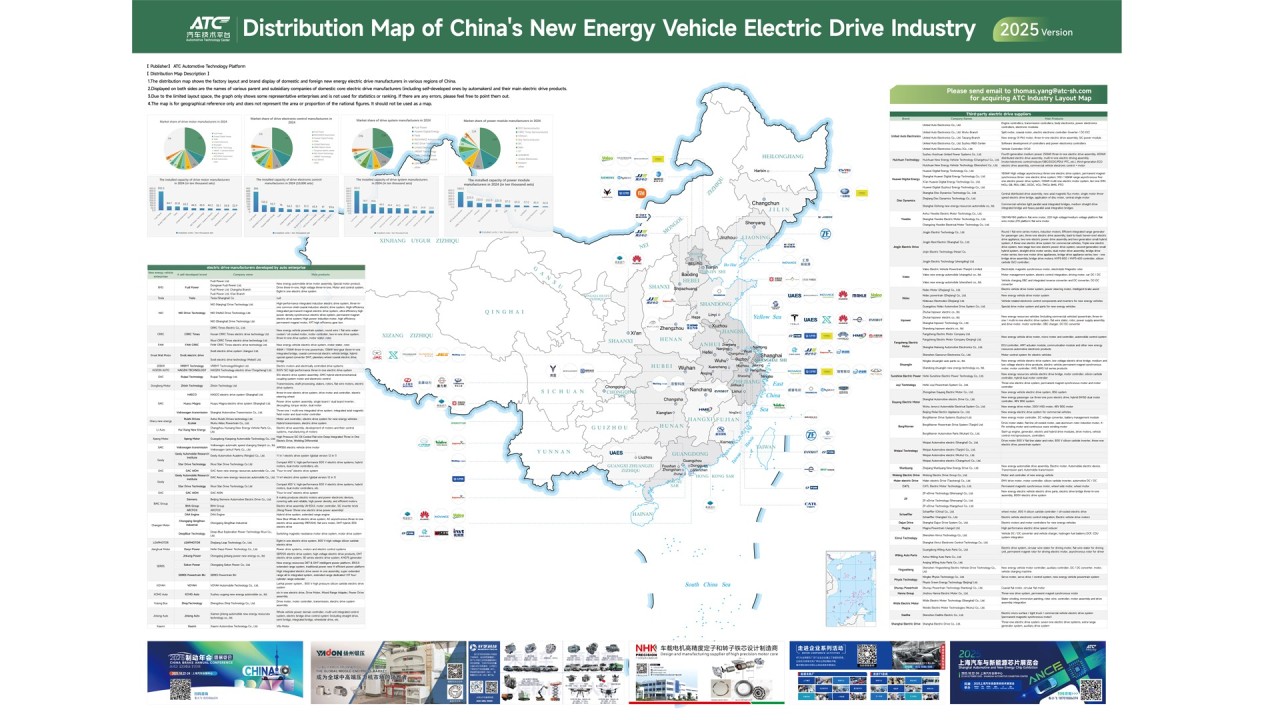

Driven by the rapidly growing market, our ATC Automotive Technology Platform successfully published 2,600 copies of the “2024 | China New Energy Vehicle Electric Drive Industry Distribution Map” in 2024, achieving remarkable results.

Therefore, in the first quarter of 2025, our ATC Automotive Technology Platform has timely updated and produced the “2025 | China New Energy Vehicle Electric Drive Industry Distribution Map” to provide for the study of professionals in the new energy electric drive field.

The “2025 | China New Energy Vehicle Electric Drive Industry Distribution Map” showcases the distribution of electric drive manufacturers’ factories, their main products, production capacity data, and a directory of electric drive component/material suppliers (including drive motors, housings, IGBT modules, sensors, permanent magnet materials, etc.) across various provinces in China. This serves as a valuable resource for market research and reference. We also take this opportunity to invite industry peers to participate in the production process and provide us with valuable suggestions.

Key improvements and considerations in this translation:

· Formal Tone: The language is formal and professional, appropriate for a business audience.

· Technical Terms: Industry-specific terms like “electric drive,” “drive motors,” “IGBT modules,” and “permanent magnet materials” are accurately translated.

· Market Size: The market size figures are clearly presented in both USD and RMB, with “USD” and “RMB” used for clarity.

· Year-Over-Year Growth: “Year-over-year growth” is a standard business term and is used here.

· Clarity and Flow: The translation maintains the original meaning while ensuring smooth and clear readability in English.

· Call to Action: The invitation to industry peers is clearly translated, maintaining the original intent.

· Proper Nouns: “ATC Automotive Technology Platform” is treated as a proper noun.

This translation should be suitable for use in business reports, presentations, or other professional communications related to the Chinese electric drive industry.

1. Map Content:

· Overview of the 2024 Market Landscape for Electric Drive Systems: This section provides a comprehensive overview of the current market status for various electric drive systems.

· Distribution of Electric Drive Manufacturers’ Factories in China: This includes a detailed map showing the geographical locations of electric drive manufacturers’ facilities across all provinces in China, along with information on their main products and production capacities.

· Directory of Electric Drive Component and Material Suppliers Nationwide: This is a comprehensive list of suppliers across China providing components and materials for electric drives, including (but not limited to) drive motors, motor housings, IGBT modules, sensors, and permanent magnet materials.

2. Print Run:

· 10,000 copies (Dimensions: 1100mm x 800mm)

3. Target Audience:

· OEMs (Original Equipment Manufacturers): Tesla, BYD, AITO, NIO, Xpeng, Li Auto, BMW, etc.

· System Integrators: Wernher of the Steppe, Phideon Power, Shanghai Edrive, Weirui Electric, GYD, United Electronic, Valeo, Fangzheng Electric, BorgWarner, etc.

· Component Suppliers: Schaeffler, Timken, SVC, SKF, Daido Metal, Synchro, Wanxiang Qianchao, CDMC, Tianma Group, Double Ring (Shuanghuan), Sheng An, etc.

· Material Suppliers: MSE, JL Mag, POSCO, Ningbo Yunsheng, Shenyang Hongyuan, Jintian Magnetics, etc.

· Third Parties: Industry associations, consulting platforms, research institutions, universities, securities companies, investment banks, etc.

4. Distribution Method (Free of Charge):

· Complimentary application and mailing.

· Distribution at ATC conferences/events.

· Distribution through partner channels.

· Direct distribution during visits.

5. Initial Release Date:

· March 2025

To obtain high-resolution images or printed maps, please contact: tami.wu@atc-sh.com